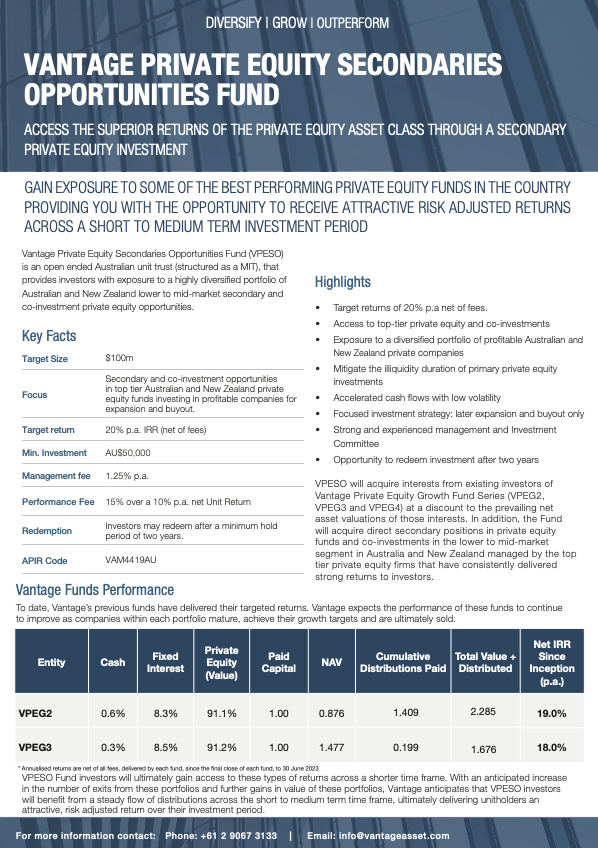

Vantage Private Equity Secondaries Opportunities is an Australian Secondary Private Equity Fund of Funds established to provide investors with access to the strong returns generated by the top performing Buyout and Later Expansion Private Equity Funds in Australia.

The Investment Manager of VPESO is managed by Vantage Asset Management Pty Limited (Vantage or Manager) holder of Australian Financial Services Licence No. 279186.

Vantage is a leading independent Australian investment management company with expertise in Private Equity, funds management, manager selection and operational management.

Since establishment in 2004, Vantage has developed and managed a Private Equity investment strategy focused exclusively on investments in the lower to mid-market segment of Private Equity in Australia and New Zealand.

These businesses often have a strong market position and generate strong cashflows allowing Vantage’s funds to generate strong consistent returns, while significantly reducing the risk of a loss within the portfolio.

Vantage has a deep understanding of the Private Equity industry, access to quality managers, strong industry relationships and an investment process that selects specialised private equity fund managers in Australia and New Zealand.

VPESO will develop a diversified portfolio of underlying investments similar to Vantage’s existing Private Equity funds, which have an emphasis on growth industry sectors including the healthcare, consumer, industrials, information technology and agricultural products sectors. However, the Fund will access Private Equity funds at a later stage of their development by investing by way of secondary private equity investments. This will be achieved by the Fund acquiring interests from existing Vantage Private Equity Growth Fund series (including VPEG, VPEG2, VPEG3 & VPEG4) investors at a discount to the prevailing net asset valuations of those interests. In addition, the Fund will acquire direct secondary positions in private equity funds in the lower to mid-market segment of Private Equity in Australia and New Zealand. A key focus in VPESO’s investment strategy is portfolio risk minimisation.

A secondary transaction allows the Fund to invest in existing underlying assets by purchasing mature underlying fund interests that are typically fully committed and close to being fully invested – containing an identifiable, fully constructed portfolio of company holdings.

Vantage also recognises the importance Investors place on liquidity and Private Equity’s general illiquid nature through the early construction phase of a portfolio’s lifecycle, typically being within the first four years of a funds life. This is mitigated through the purchasing of existing private equity assets, which ultimately reduces the illiquid duration timeline of primary private equity commitments accelerating cash flows to investors in the medium term.

With VPESO’s focus on building a diversified portfolio of existing interests from Vantage Private Equity Growth Fund series funds as well as direct secondary positions and selective co-investment opportunities, Vantage is confident that the Fund can consistently deliver a superior return to investors.

VPESO is targeting to deliver a net return of 20% per annum net of fees to Investors over a two to four year time frame. The Investment Committee, along with the executives of Vantage will provide a strong and experienced team to manage the Fund towards its objectives.