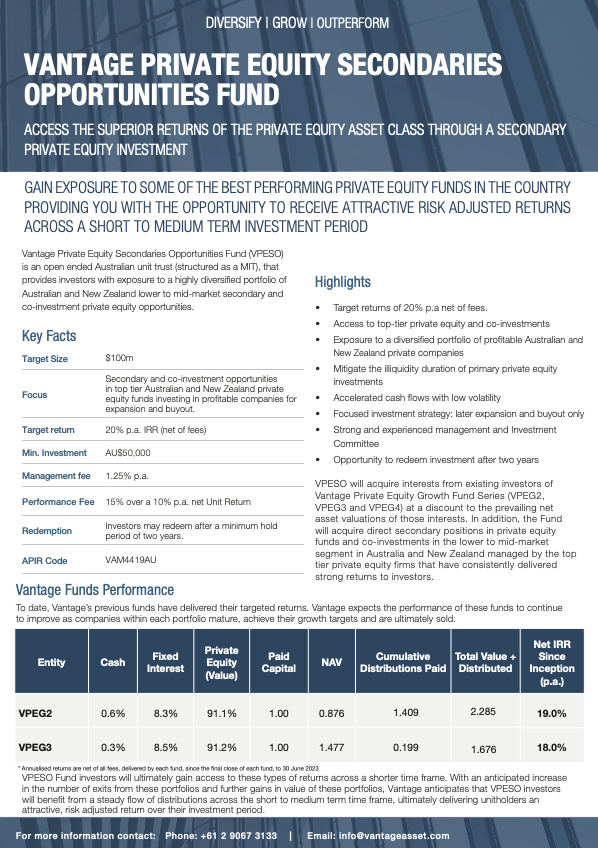

Each underlying Private Equity fund commitment or direct co-investment made by VPESO will be valued on a monthly basis in accordance with the International Private Equity Investment Valuation Guidelines, endorsed by the Australian Investment Council (AIC). As a result, each underlying private equity investment held by each VPESO entity is valued monthly, with individual company investments valued on a multiple of earnings basis, with all valuations independently audited at least annually and often more frequently. VPESO’s monthly valuations therefore represent a transparent summary of the performance of its underlying portfolio.

VANTAGE PRIVATE EQUITY SECONDARIES OPPORTUNITIES – VALUATIONS

The Net Trust Value of the Fund will be calculated and provided to Investors on a monthly basis. The Net Trust Value of the Fund will be audited annually at the end of each Financial Year.

VPESO NET ASSET VALUE – MONTHLY VALUATION

Month Ending

Cash

Fixed Interest Investments

Private Equity (Value)

NAV Per Unit ($)

Distribution Paid ($)

Cumulative Distribution Paid ($)

31-Mar-2024

0.0%

2.5%

97.5%

1.285

0.087

29-Feb-2024

0.0%

5.0%

95.0%

1.280

0.087

31-Jan-2024

0.1%

7.5%

92.4%

1.268

0.087

31-Dec-2023

0.0%

7.5%

92.5%

1.262

0.087

30-Nov-2023

0.5%

6.7%

92.8%

1.258

0.087

31-Oct-2023

0.8%

7.7%

91.4%

1.259

0.057

0.087

30-Sep-2023

0.0%

22.7%

77.2%

1.303

0.030

31-Aug-2023

0.1%

2.2%

97.8%

1.198

0.030

31-Jul-2023

0.0%

2.5%

97.5%

1.201

0.030

30-June-2023**

0.1%

6.0%

93.9%

1.207

0.030

31-May-2023

0.0%

6.2%

93.8%

1.188

0.030

30-Apr-2023

0.1%

11.1%

88.8%

1.175

0.030

31-Mar-2023

0.2%

15.2

84.6%

1.160

0.030

28-Feb-2023

0.3%

15.8%

83.9%

1.198

0.030

31-Jan-2023

2.4%

14.1%

83.5%

1.196

0.030

31-Dec-2022

2.0%

14.1%

83.8%

1.201

0.030

30-Nov-2022

0.3%

15.7%

84.0%

1.169

0.030

31-Oct-2022

16.1%

16.1%

83.7%

1.167

0.030

0.030

30-Sep-2022

11.4%

11.4%

88.4%

1.155

31-Aug-2022

0.1%

0.8%

99.2%

1.170

31-Jul-2022

0.2%

0.9%

99.1%

1.168

30-Jun-2022*

0.0%

1.3%

98.6%

1.220

31-May-2022

0.0%

0.0%

100.0%

1.227

30-Apr-2022

0.1%

2.4%

97.4%

1.236

31-Mar-2022

0.1%

2.4%

97.4%

1.243

28-Feb-2022

0.4%

2.6%

97.1%

1.192

31-Jan-2022

5.4%

0.0%

94.6%

1.193

31-Dec-2021

9.6%

0.0%

90.4%

1.195

30-Nov-2021

15.8%

0.0%

84.2%

1.192

31-Oct-2021

18.0%

0.0%

82.0%

1.197

30-Sep-2021

24.4%

0.0%

75.8%

1.199

31-Aug-2021

0.0%

0.0%

94.5%

1.160

31-Jul-2021

100.0%

0.0%

0.0%

1.000

| Month Ending | Cash | Fixed Interest Investments | Private Equity (Value) | NAV Per Unit ($) | Distribution Paid ($) | Cumulative Distribution Paid ($) |

|---|---|---|---|---|---|---|

| 31-Mar-2024 | 0.0% | 2.5% | 97.5% | 1.285 | 0.087 | |

| 29-Feb-2024 | 0.0% | 5.0% | 95.0% | 1.280 | 0.087 | |

| 31-Jan-2024 | 0.1% | 7.5% | 92.4% | 1.268 | 0.087 | |

| 31-Dec-2023 | 0.0% | 7.5% | 92.5% | 1.262 | 0.087 | |

| 30-Nov-2023 | 0.5% | 6.7% | 92.8% | 1.258 | 0.087 | |

| 31-Oct-2023 | 0.8% | 7.7% | 91.4% | 1.259 | 0.057 | 0.087 |

| 30-Sep-2023 | 0.0% | 22.7% | 77.2% | 1.303 | 0.030 | |

| 31-Aug-2023 | 0.1% | 2.2% | 97.8% | 1.198 | 0.030 | |

| 31-Jul-2023 | 0.0% | 2.5% | 97.5% | 1.201 | 0.030 | |

| 30-June-2023** | 0.1% | 6.0% | 93.9% | 1.207 | 0.030 | |

| 31-May-2023 | 0.0% | 6.2% | 93.8% | 1.188 | 0.030 | |

| 30-Apr-2023 | 0.1% | 11.1% | 88.8% | 1.175 | 0.030 | |

| 31-Mar-2023 | 0.2% | 15.2 | 84.6% | 1.160 | 0.030 | |

| 28-Feb-2023 | 0.3% | 15.8% | 83.9% | 1.198 | 0.030 | |

| 31-Jan-2023 | 2.4% | 14.1% | 83.5% | 1.196 | 0.030 | |

| 31-Dec-2022 | 2.0% | 14.1% | 83.8% | 1.201 | 0.030 | |

| 30-Nov-2022 | 0.3% | 15.7% | 84.0% | 1.169 | 0.030 | |

| 31-Oct-2022 | 16.1% | 16.1% | 83.7% | 1.167 | 0.030 | 0.030 |

| 30-Sep-2022 | 11.4% | 11.4% | 88.4% | 1.155 | ||

| 31-Aug-2022 | 0.1% | 0.8% | 99.2% | 1.170 | ||

| 31-Jul-2022 | 0.2% | 0.9% | 99.1% | 1.168 | ||

| 30-Jun-2022* | 0.0% | 1.3% | 98.6% | 1.220 | ||

| 31-May-2022 | 0.0% | 0.0% | 100.0% | 1.227 | ||

| 30-Apr-2022 | 0.1% | 2.4% | 97.4% | 1.236 | ||

| 31-Mar-2022 | 0.1% | 2.4% | 97.4% | 1.243 | ||

| 28-Feb-2022 | 0.4% | 2.6% | 97.1% | 1.192 | ||

| 31-Jan-2022 | 5.4% | 0.0% | 94.6% | 1.193 | ||

| 31-Dec-2021 | 9.6% | 0.0% | 90.4% | 1.195 | ||

| 30-Nov-2021 | 15.8% | 0.0% | 84.2% | 1.192 | ||

| 31-Oct-2021 | 18.0% | 0.0% | 82.0% | 1.197 | ||

| 30-Sep-2021 | 24.4% | 0.0% | 75.8% | 1.199 | ||

| 31-Aug-2021 | 0.0% | 0.0% | 94.5% | 1.160 | ||

| 31-Jul-2021 | 100.0% | 0.0% | 0.0% | 1.000 |

* Before End of Year Distribution of $0.03/unit and Performance Fees, both payable in October 2022

** Before End of Year Distribution of $0.057/unit payable in October 2023