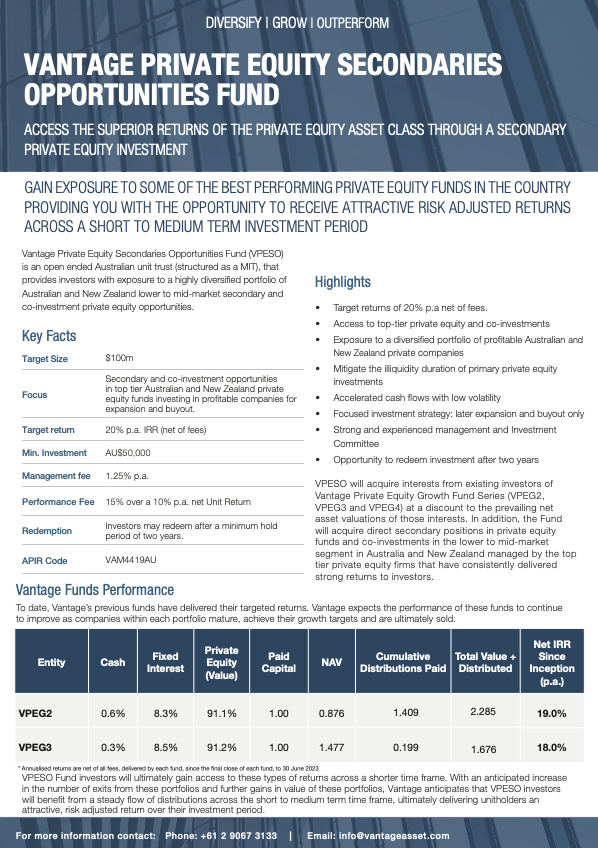

VPESO will acquire interests from existing investors of Vantage Private Equity Growth Fund Series (VPEG2, VPEG3 and VPEG4) at a contractual discount to the prevailing net asset valuations of those interests. In addition, the Fund will acquire direct secondary positions in private equity funds in the lower to mid-market segment in Australia and New Zealand managed by experienced Private Equity firms that have consistently delivered strong returns to investors.

Strong Investment Returns

Vantage only invests in secondary private equity opportunities whose managers have delivered top tier performance

Liquidity

Secondary Private Equity investments demonstrate the characteristics of a shorter investment hold period, delivering accelerated returns across a shorter investment period, than a holding in a single private equity fund

Downside Protection

Immediate access to a diversified secondary Private Equity investment strategy, significantly reducing the risk for investors.

Innovative Fund Structure

Open ended fund structure providing liquidity to investors in a shorter duration, within an asset class that is typically deemed illiquid.

Scale

Aggregation fund vehicles that deliver the necessary scale to successfully invest in the asset class

Access

Gain access to a diversified portfolio of Private Equity funds managed by high performing managers, selected by a locally based investment team

Diversification

Achieved through execution of a diversified investment strategy with investment across managers, financing stage, industry sector, vintage years and geographic regions.

Strong Experienced Team

Over the past twenty years, Vantage’s executives have built deep relationships with leading Private Equity managers. These relationships play a critical role in Vantage accessing fund investment opportunities.

Investor Communication

Vantage has developed a tailored communication strategy providing detailed frequent and transparent reporting to investors.

Competitive Fees

Vantage’s Funds have one of the lowest fee structures in the market