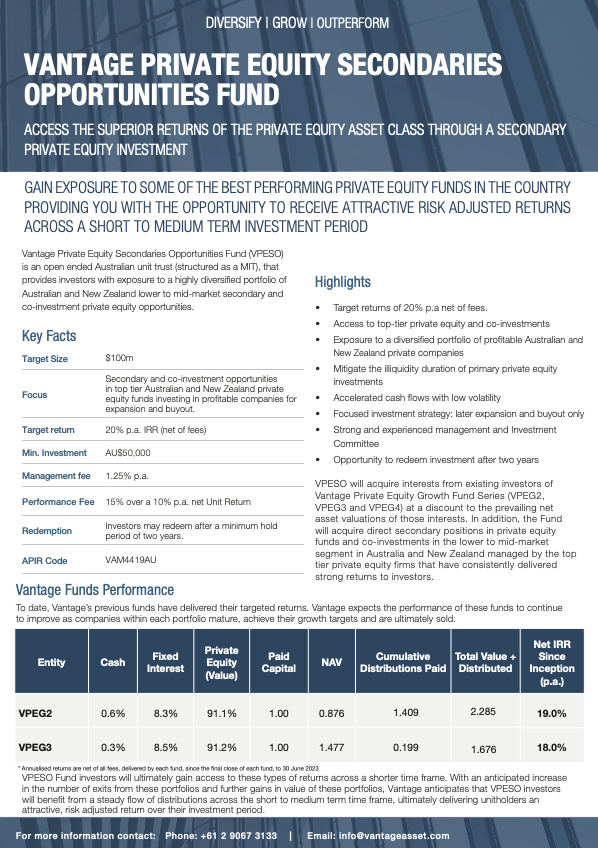

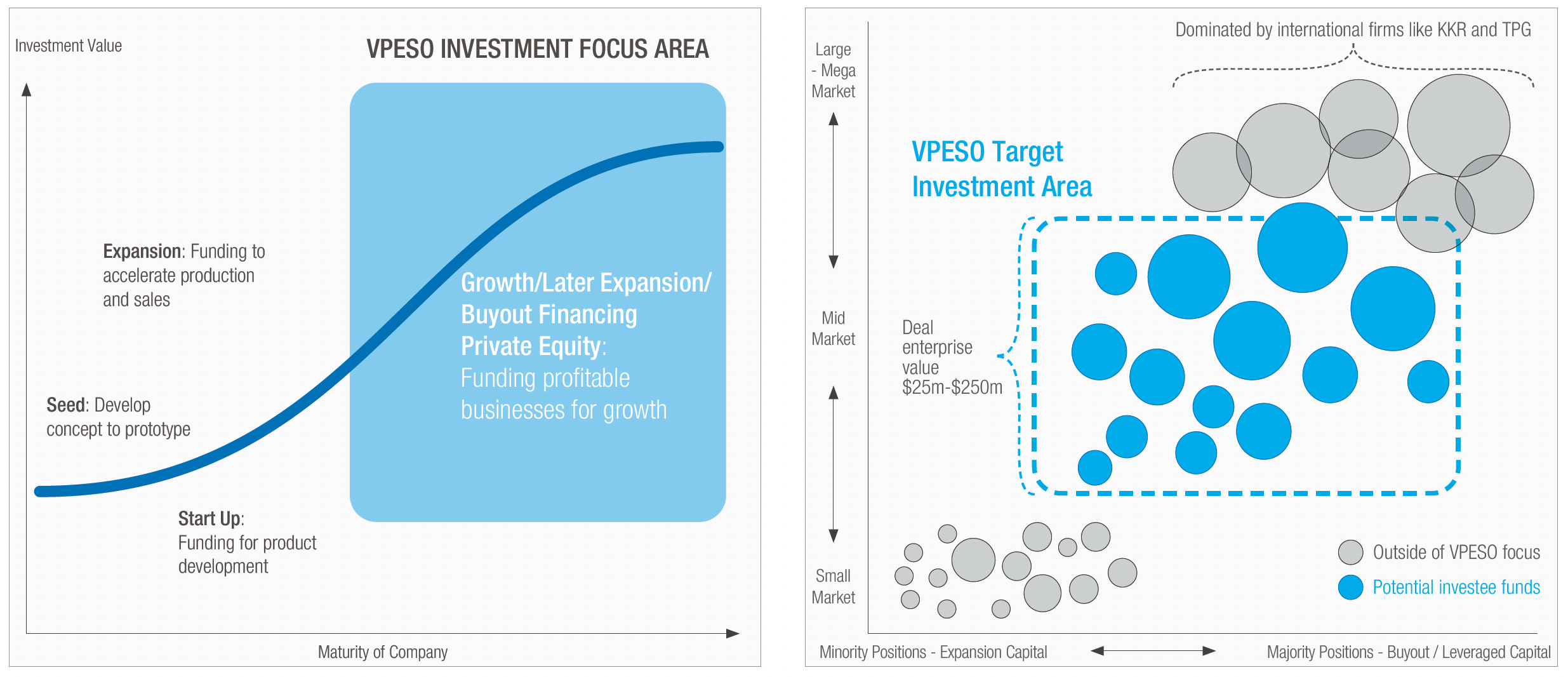

VPESO’s investment strategy only invests in secondary opportunities that are within the Growth / Later Expansion / Buyout Financing stages of Private Equity. These stages of Private Equity invest in profitable businesses with proven products and services. These businesses typically have a strong market position and generate strong cash flows.

Furthermore, VPESO will only invest in funds targeting lower to mid market sized investments with an enterprise value of generally between $25m to $250m at investment. It is this segment of private equity investing that has consistently delivered strong returns to investors globally over the past three decades.

In more detail, VPESO’s investment strategy will evolve as follows:

Secondary Private Equity Fund Investments

The Fund will make investments in secondary Private Equity fund investments focused on the lower to mid-market Private Equity segment in Australia and New Zealand. This will be achieved by acquiring interests from existing Vantage Private Equity Growth Fund series (VPEG, VPEG2, VPEG3 & VPEG4) investors at a discount to the prevailing net asset valuations of those interests. In addition, the Fund will acquire direct secondary positions in Private Equity funds in the lower to mid-market segment of Private Equity in Australia and New Zealand.

Co-Investments

The Fund will adopt a strategy whereby direct co-investments may be made in exceptional underlying businesses identified by Private Equity fund managers. This will be achieved by utilising the expertise of the Manager and the extensive proprietary deal flow of the underlying fund’s managers. The intention of this approach is to provide further diversification and enhance the opportunity for a superior return on investment for the Fund. Subject to the terms of any arrangements with the relevant Private Equity manager, the Fund may allocate up to 20% of the Fund’s net asset value for co-investments in accordance with the Investment Guidelines described in this section. No single permitted co-investment will represent more than 5% of the net asset value of the Fund in accordance with the Fund’s Investment Guidelines.

A Highly Diversified Private Equity Portfolio

As the Fund’s portfolio is developed over time, a portfolio of more than 50 underlying private company investments will result, spread across a range of growth industry sectors including; healthcare, consumer, industrials, information technology and agricultural products sectors. This provides Investors with the benefits of a highly diversified portfolio of Private Equity investments, a key factor in the Fund’s risk minimisation strategy.

Diversification of the Fund’s secondary Private Equity portfolio will be achieved by spreading investments across private assets in five ways, by:

- Fund Manager;

- Financing Stage;

- Industry Sector;

- Geographic Region; and

- Vintage Year.

As the Fund continues to invest over time, the maximum percentage allocated to any one secondary Private Equity fund investment is expected to be no more than 30% of the target net asset value of the Fund.

Dynamic Allocation

The objective of the dynamic allocation strategy is to achieve a reduced volatility of returns to the Fund over the medium term and optimise the allocation of the Fund’s investment portfolio to the highest performing assets.

The Manager utilises sophisticated analytical techniques for the modelling and analysis of underlying funds and their underlying investments in order to identify the spread in performance of underlying funds to comparable within the specific financing stage, geographic region and Vintage Year. This information is then utilised by the Manager to continually refine the allocation of investments across the highest performing sectors and underlying managers.

Distributions

Distributions received by the Fund from each asset of the Fund will be automatically re-invested for additional Units in the Fund on a pro rata basis for each Investor.

Becoming an Investor

The Issue Price of each Unit in a Class on the First Issue Date was $1.00. The Trustee will issue units in the Fund effective on the relevant Closing Date after the unit price has been determined. The price at which a Unit issued subsequent to the initial issue of Units, is equal to the aggregate of the Net Unit Value as at the date the Unit is issued plus the buy spread which is equivalent to the Trustee estimated Transaction Costs in issuing units subsequent to the initial issue of Units.