- There is less competition for deals, businesses can be purchased at lower purchase multiples and lower levels of debt are utilised in this segment than the highly competitive, large or mega market private equity fund space, that is dominated by global private equity firms.

- The majority of growth in value of private equity backed businesses in this segment is generated by sustainable earnings enhancement rather than the financial engineering or cost cutting approach that is typical of the larger market space.

- Private Equity executives work more actively in partnership with the management of portfolio companies in this segment and bring deep financial and business skills as well as the broad networks and experience that are essential for transformational business growth.

- This segment also benefits from the ability for Private Equity funds to exit (or sell) portfolio companies by several different methods, including;

- an Initial Public Offer (or listing on a public market),

- a Trade Sale to a larger industry player or

- as a “Secondary Sale” to a larger, often global, private equity fund.

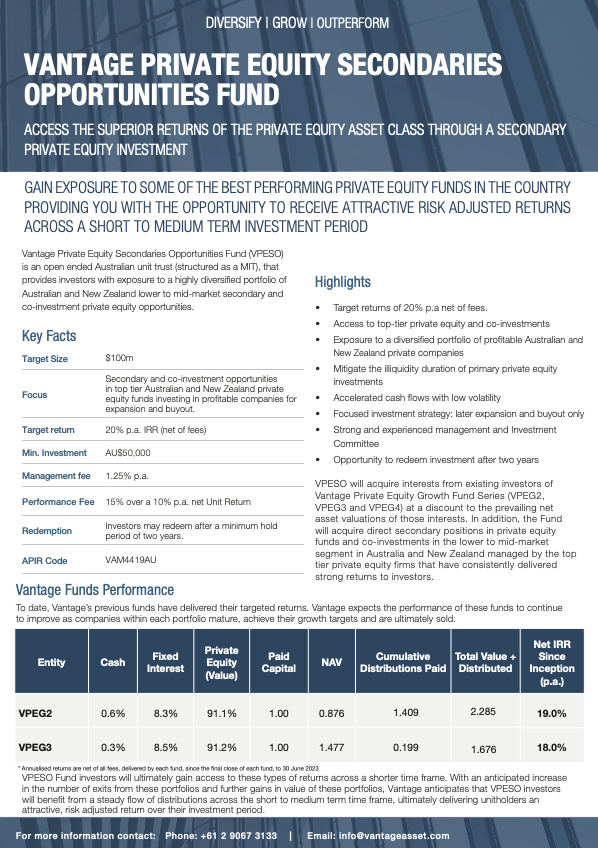

Secondary acquisitions will be achieved by acquiring, at a discount to current valuations, direct secondary positions in private equity funds, interests from existing Vantage Private Equity Growth Fund series (VPEG2, VPEG3 & VPEG4) investors, as well as selectively investing in co-investments, led by specialised private equity

fund managers, into profitable companies.

As VPESO develops its Private Equity portfolio over time, a summary of each underlying fund commitment and investment is provided below.

February 2022

VPESO’s Investment Committee approve a $2 million co-investment alongside Allegro Fund IV into Gull New Zealand, a leading independent fuel distributor and retailer in New Zealand with a prominent challenger brand through its network of 112 fuel sites across the country, regional New South Wales.

September 2022

VPESO’s Investment Committee approve a $2 million co-investment alongside Next Capital Fund IV into Compare Club, one of Australia’s leading personal finance marketplaces, currently offering comparison and brokerage services across health insurance, life insurance and home loan products.

April 2023

VPESO Completes the Secondary acquisition of a $1.0 million investment commitment and underlying investments in Genesis Capital Fund I.

Details of VPESO′s Current Secondary Private Equity Acquisitions:

Acquisition

Fund / Deal Size

Vintage Year

Investment Focus / Type

VPESO Acquired Commitment

Paid-in Capital

Total No. of Investee Companies

No. of Exits

Advent Partners 2

$300m

2017

Lower to Mid Market Growth / Buyout

$10.0m

$9.33m

7

1

Anchorage Capital Partners Fund III

$350m

2017

Mid Market Turnaround / Buyout

$5.0m

$4.94m

5

2

Vantage Private Equity Growth 3 (VPEG3)

$67.5m

2019

Fund of Funds - Lower to Mid Market Growth / Buyout / Turnaround

$6.70m

$5.34m

50

10

The Growth Fund III

$450m

2017

Mid Market Expansion / Buyout

$1.10m

$0.64m

8

0

Vantage Private Equity Growth 4 (VPEG4)

$180m

2021

Fund of Funds - Lower to Mid Market Growth / Buyout / Turnaround

$6.00m

$5.38m

12

1

Co-invest No.1 (Gull New Zealand)

~$500m

2022

Mid Market Special Situations

$1.10m

$0.62m

31

1

Co-invest No.2 (Compare Club)

$110m

2022

Lower to Mid Market Expansion

$2.00m

$2.00m

1

0

Co-invest

No. 3 (Pac Trading)

$71m

2023

Lower to Mid

Market Growth Capital / Buyout

$1.00m

$1.02m

1

0

Totals**

$34.90m

$31.27m

104

12

| Acquisition | Fund / Deal Size | Vintage Year | Investment Focus / Type | VPESO Acquired Commitment | Paid-in Capital | Total No. of Investee Companies | No. of Exits |

|---|---|---|---|---|---|---|---|

| Advent Partners 2 | $300m | 2017 | Lower to Mid Market Growth / Buyout | $10.0m | $9.33m | 7 | 1 |

| Anchorage Capital Partners Fund III | $350m | 2017 | Mid Market Turnaround / Buyout | $5.0m | $4.94m | 5 | 2 |

| Vantage Private Equity Growth 3 (VPEG3) | $67.5m | 2019 | Fund of Funds - Lower to Mid Market Growth / Buyout / Turnaround | $6.70m | $5.34m | 50 | 10 |

| The Growth Fund III | $450m | 2017 | Mid Market Expansion / Buyout | $1.10m | $0.64m | 8 | 0 |

| Vantage Private Equity Growth 4 (VPEG4) | $180m | 2021 | Fund of Funds - Lower to Mid Market Growth / Buyout / Turnaround | $6.00m | $5.38m | 12 | 1 |

| Co-invest No.1 (Gull New Zealand) | ~$500m | 2022 | Mid Market Special Situations | $1.10m | $0.62m | 31 | 1 |

| Co-invest No.2 (Compare Club) | $110m | 2022 | Lower to Mid Market Expansion | $2.00m | $2.00m | 1 | 0 |

| Co-invest No. 3 (Pac Trading) | $71m | 2023 | Lower to Mid Market Growth Capital / Buyout | $1.00m | $1.02m | 1 | 0 |

| Totals** | $34.90m | $31.27m | 104 | 12 | |||

**Totals include only investments or exits completed as at 31 March 2023 and excludes duplicates