Given the increase in demand for secondary private equity investments and the underlying deal flow, Vantage Private Equity Secondaries Opportunities Fund (VPESO or the Fund) will be open for new and existing investors to capture secondary and co-investment opportunities in the market that the Fund is currently pursuing. Given the increase in demand for the VPESO product and the underlying deal flow, VPESO management are targeting to raise $10 million of new capital during the capital raise window ending COB on 30th June 2022 or as soon as the target raise is reached. The campaign will commence on 30th May 2022, allowing existing and new investors to gain exposure to some of the best performing Private Equity Funds in the country delivering accelerated returns over a shorter investment period than a traditional primary private equity fund commitment.

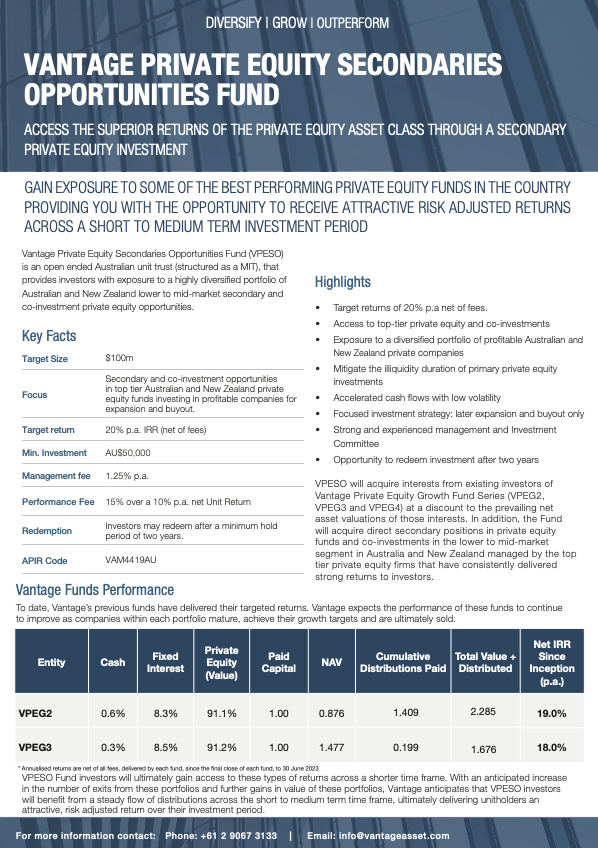

VPESO’s Net Asset Value has increased 24.3% since inception on 23 July 2021 to 31 March 2022 representing a net annualised return of 37.2% per annum. This return is as a result of the strong performance of VPESO’s underlying investments Vantage Private Equity Growth 3 (VPEG3), as well as from both Advent Partners Fund 2 and Anchorage Capital Partners Fund III which continue to improve.

As at 31 March 2022, VPEG3 had generated a net annualised return to investors of 29.2% p.a. Advent Partners 2 Fund has made seven portfolio company investments and completed one exit to date. The average hold period of each company is 1.7 years. Advent management have added significant value to their portfolio companies through improving operational efficiencies and by performing a number of strategic acquisitions, resulting in an average revenue and EBITDA growth of 78.45% an 83.86% respectively. Anchorage Capital Partners Fund III has made investments into 4 portfolio companies, with a current average investment hold period of 1.94 years. Anchorage management are experiencing strong interest from foreign investors for a number of Anchorage III portfolio companies, with one of these company’s in the later stages of exit discussions, which once completed will provide strong returns and distributions to VPESO.

As VPESO’s underlying funds and investments mature over time, the value of each fund has demonstrated that it continues to increase, as underlying Private Equity managers actively work alongside their portfolio company executives to deliver growth and efficiencies in order to maximise exit value. VPESO allows investors access to discounted investments at a later stage of the private equity lifecycle, theoretically ‘skipping’ the initial negative cashflow period normally experienced in private equity investments. This will result in enhanced returns to investors across a shorter time frame.

If you would like to invest into the latest VPESO Fund Capital Raise, an application can be completed simply through the Fund’s secure online application form by clicking on the relevant link below:

If you wish to learn more about VPESO as a potential investment opportunity, please contact your financial advisor or alternatively email [email protected] to request a meeting with a Vantage executive for more information.