In July 2021, VPESO entered into a contract to acquire a total of $15m of investments and commitments from an existing investor in the Advent Partners 2 Fund (AP2) and Anchorage Capital Partners Fund III (ACPIII), across three stages.

Advent Partners 2 Fund is managed by leading Australian mid-market private equity manager, Advent Partners of Melbourne. the Fund is a $300m fund, which was established in 2017, for investment into lower to mid-market expansion and buyout opportunities in Australia and New Zealand. AP2 seeks to invest between $15m to $50m into businesses with low capital intensity and strong market positions, operating in industries experiencing strong growth. Advent Partners’ target industry sectors include healthcare, consumer branded, proven technology & software, education & training and leading-edge businesses.

Anchorage Capital Partners Fund III is managed by specialised private equity firm Anchorage Capital Partners of Sydney. ACFIII is a $350m fund established in 2017, for investment into lower to mid-market opportunities in Australia and New Zealand. ACFIII seeks control investments in established businesses with a strong market position or brand which are not performing at their full potential, often as a result of capital constraints, lack of management attention or being a non-core ‘orphan’ in a large corporate.

On 31 July 2021, the first stage of the contracted acquisition was completed with $5m of investments and commitments in AP2 added to VPESO’s portfolio. By 31 August 2021, the second stage of the contracted acquisition was completed with $5m of investments and commitments in ACPIII added to VPESO’s portfolio.

By 30 September 2021, the third and final stage of the contracted acquisition was completed with a further $5m of investments and commitments in AP2 added to VPESO’s portfolio.

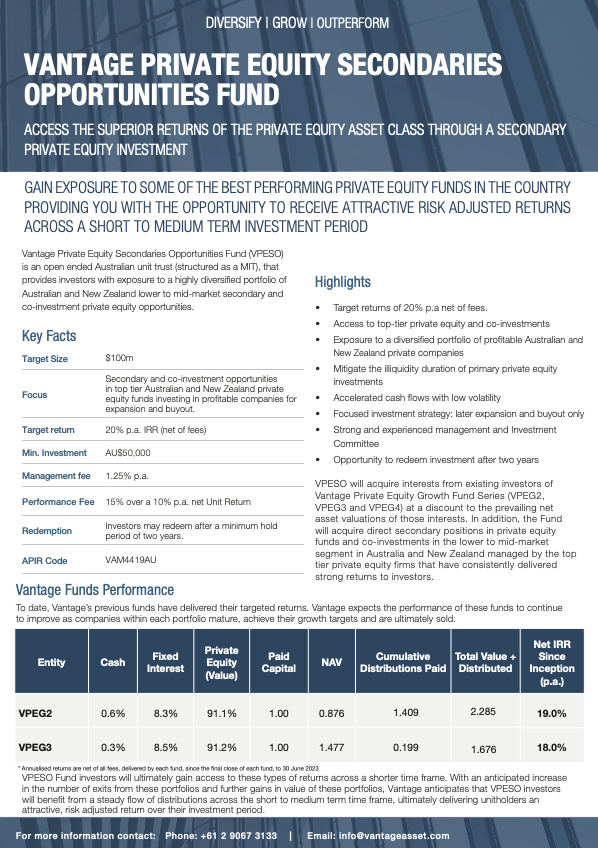

VPESO also acquired $1.5m of commitments and investments in Vantage Private Equity Growth 3, LP (VPEG3).

Vantage Private Equity Growth 3 is a multi-manager Private Equity investment fund consisting of Vantage Private Equity Growth 3, LP (VPEG3, LP) an Australian Fund of Funds (AFOF) Limited Partnership and Vantage Private Equity Growth Trust 3A (VPEG3A) an Australian Unit Trust, established to undertake private equity investments that are not permitted to made by an AFOF, in accordance with Australian regulations.

VPEG3 commenced investing in 2017 and invests the majority of its Investment Portfolio into Australian based private equity funds who in turn are focused on investing into lower to mid-market sized companies headquartered in Australia and New Zealand, with enterprise values of between $25 million and $250 million at investment.

VPEG3 has developed a diversified portfolio of underlying investments by investing into seven underlying private equity funds in which it has made investment commitments, who in turn are focused on investments into profitable companies in defensive and growth industry sectors including the Healthcare, Consumer Staple, Information Technology and Agricultural Products.

As a result of these secondary acquisitions, VPESO ultimately held interests in 34 unique underlying company investments at the September 2021 quarter end.